Today on CAG

(PCDD) Alan Wake 2 $39.99 (DRM: EPIC) via Humble Bundle.

$47.99 via PSN (PS Plus Price).

(PCDD) Grey Hack $14.99 via Steam.

(PCDD) Junkyard Simulator $6.29 via Steam.

(PCDD) DYSMANTLE $6.99 via Steam.

(PCDD) Cardboard Town $7.99 via Steam.

PSN.

Steam.

Box Lunch w/ Code: BLGIFTS .

Gamesplanet.

Walmart.

GameStop.

Target.

Star Wars Day Sales.

Amazon.

Best Buy.

GOG.

Humble.

EE.

Gamebillet.

Xbox.

eShop.

(PCDD) May Madness Flash Sales via Fanatical.

Six Official Legend of Zelda Glasses (16 oz) $20.99 via Newegg (Free Shipping).

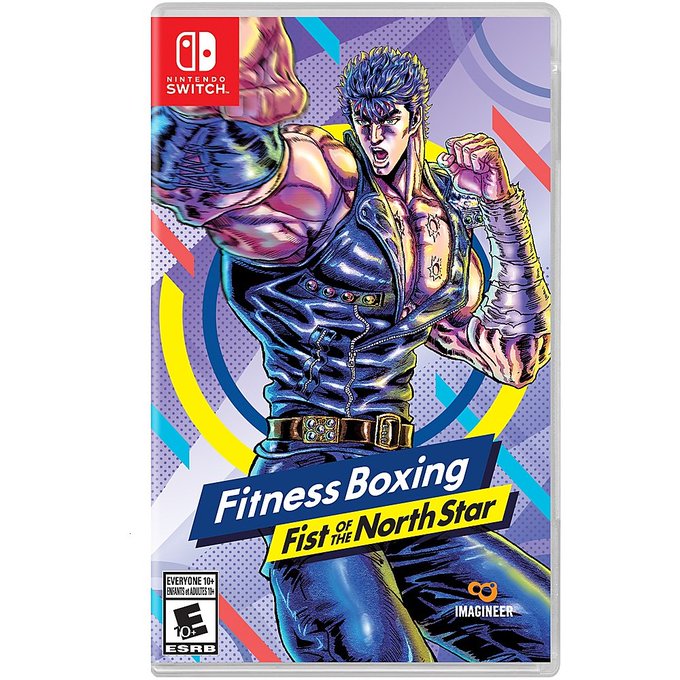

Fitness Boxing Fist of the North Star (S) $39.99 via Walmart (Walmart+ Eligible).

Amazon (Prime Eligible).

Best Buy.

Target.

Logitech Star Wars Computer Accessories sale via Amazon (Prime Eligible).

Headsets Sale.

Star Wars Jedi: Survivor (PS5/X) $24.99 via Amazon (Prime Eligible).

Game Pass via Xbox.

Pre-Order: Bitmap Bureau Collection (S/PS5) $49.99 via Amazon (Prime Eligible).

S

PS5

Star Wars sale via Amazon (Prime Eligible).

Star Wars - The Black Series Darth Revan Lightsaber $189.99 via Best Buy.

LEGO Star Wars: The Skywalker Saga (PS5/S) $19.99 via Best Buy.

Star Wars Sale via Best Buy.

Mineko's Night Market (S/PS5) $14.99 via Woot (Amazon Prime Eligible).

RWBY: Arrowfell (S) $14.99 via eShop.

PSN.

(PCDD) Star Wars The Force Unleashed Ultimate Sith Ed. $4.99 (DRM: Steam) via Humble Bundle.

DLC lets you murder beloved Star Wars characters.

Regular Edition $4.99

Xbox

eShop

Returnal (PS5) $29.39 via PSN.

PS Plus Extra on PSN.

$44.99 (DRM: Steam) via Gamebillet.

(PCDD) STAR WARS: Dark Forces Remaster & Dark Forces (Classic, 1995) $20.99 via GOG.

Just Remaster:

Steam.

PSN.

Xbox.

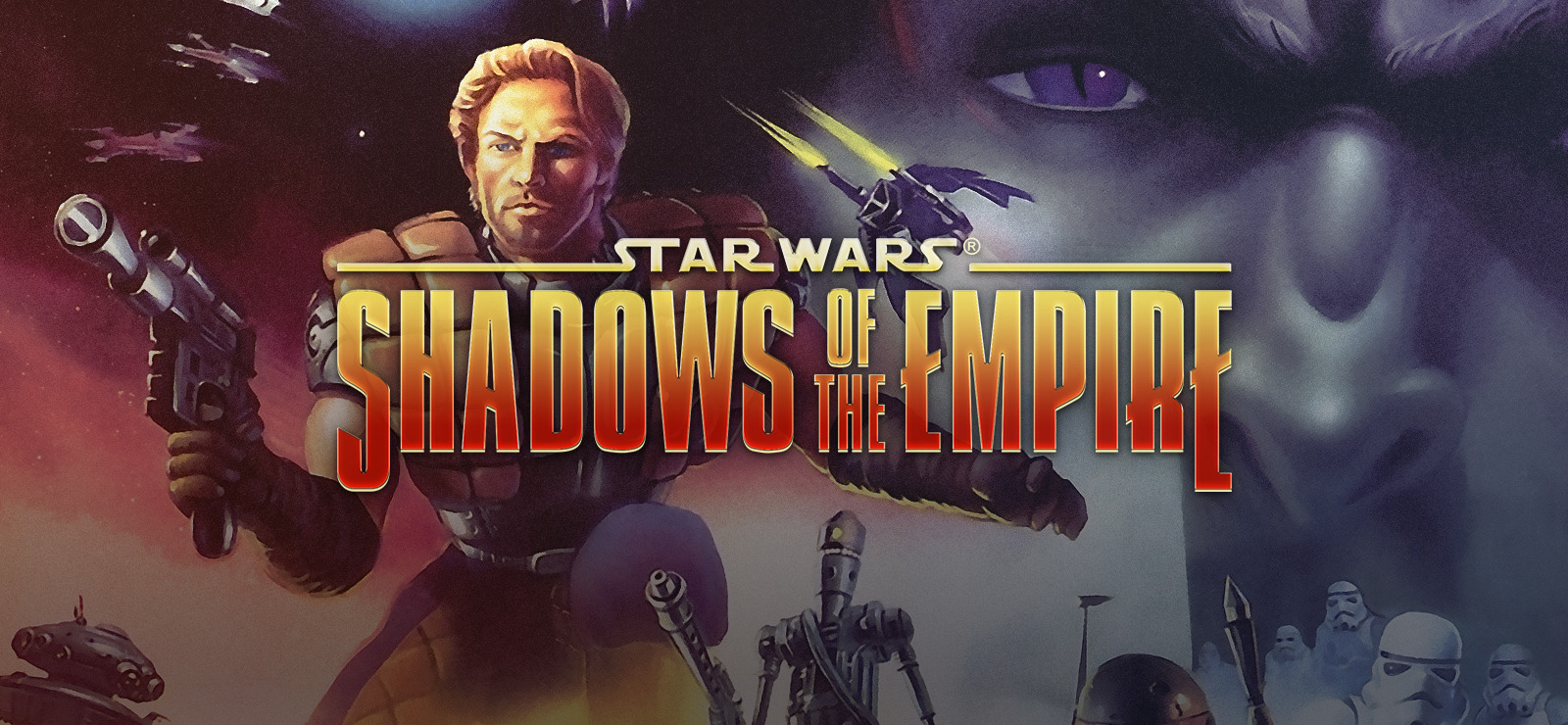

(PCDD) STAR WARS Shadows of the Empire $1.49 via GOG.

Steam.

Alan Wake 2 (PS5) $47.99 via PSN (PS Plus Price).

bread's done