speedracer

Banned

So it's been years now. When does the magical free market fairy show up and reward Britain for doing that thing that everyone says will make the magic free market fairy show up?

tl;dr list:

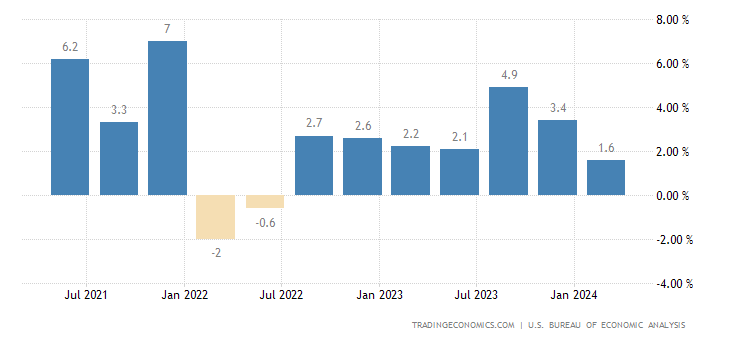

US GDP Growth:

2011: 1.8

2012: 1.7**

2013*: 2.5

UK GDP Growth:

2011: 0.8

2012: -0.1

2013*: 1.2

*projected

**lowest projection, highest is 2.1

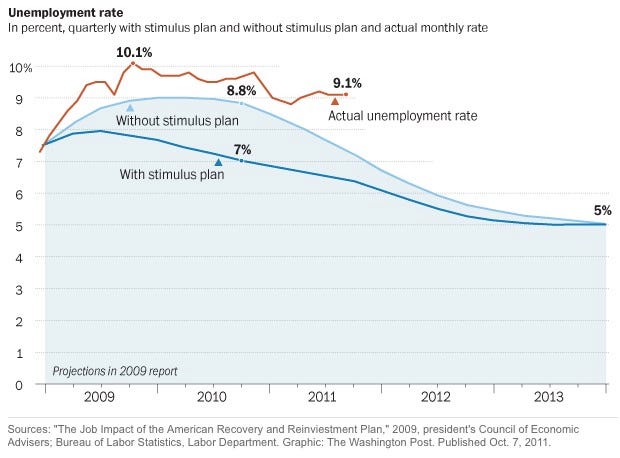

They cut government to cut debt. Income goes down. Debt goes up. So they cut government to cut debt. Income goes down. Debt goes up. When does the free market fairy get here again? Why isn't it working? And after all this, they STILL HAVE MORE DEBT THAN WHEN THEY STARTED.

Anyone?

They cut and cut and man did the jobs and capital inflow come like crazy! Oh wait, their economy actually contracted. Well, it's been years. At least capital realizes that Britain is serious about cutting their deficit and will be returning any day now. Their projections must show that, right?Britain is facing an additional year of austerity after the government said Wednesday it missed one of its self-imposed debt reduction targets because the economic recovery was weaker than expected. George Osborne, the Chancellor of the exchequer, said it would take four years instead of three for Britain to start reducing its debt as a share of national income. Speaking in Parliament to give an update on the economy, Mr. Osborne said austerity measures would now stretch to 2018.

He maintained, however, that the debt reduction plan was on track, attracting some heckling and laughter from some members of Parliament.

The government had previously planned to start cutting debt as a share of gross domestic product by 2015-2016.

The Office for Budget Responsibility, a non-partisan body that is monitoring the economy, has reduced its forecast and now expects the economy to shrink 0.1 percent this year, as opposed to 0.8 percent growth.

1.2%, which is not particularly good. Obama has been getting roasted for sluggish growth and the US GDP went up how much LAST year? 1.8%, which is 30%+ better than England's (projected) best year since austerity measures? And US GDP is currently projecting at 1.7%-2.1% for 2012.In 2013, the OBR expects a mere 1.2-per-cent growth, down from 2 per cent. In 2014, the GDP is expected to rise by 2 per cent instead of 2.7 per cent.

tl;dr list:

US GDP Growth:

2011: 1.8

2012: 1.7**

2013*: 2.5

UK GDP Growth:

2011: 0.8

2012: -0.1

2013*: 1.2

*projected

**lowest projection, highest is 2.1

They cut government to cut debt. Income goes down. Debt goes up. So they cut government to cut debt. Income goes down. Debt goes up. When does the free market fairy get here again? Why isn't it working? And after all this, they STILL HAVE MORE DEBT THAN WHEN THEY STARTED.

Anyone?

Last edited by a moderator: