[quote name='joeboosauce']Hate to burst your bubble! (pun intended!) Maybe this will burst the bubble!

Student Debt Is Perfectly Following the Financial Meltdown Script

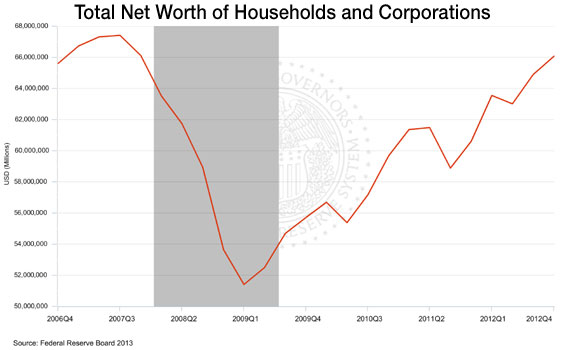

Just when the stock market recovers and public optimism returns and you start to lose faith in the power of American capitalism to constantly repeat its past mistakes in the form of foreseeable boom-and-bust cycles that always end in massive losses, the system steps up to reinforce your belief in humanity's fundamental unwillingness to learn from past mistakes, ever. Hello, looming student loan meltdown!

You may recall the last financial meltdown we had, less than five years ago, occurred when the system issued too much housing debt to people unable to repay it, and then packaged that debt into securities and sold it off to investors hungry for "yield" who didn't really care about how fundamentally sound that debt was, like a game of debt hot potato, so that every single layer of person involved in the process was only concerned about their own short term gain, and no one had much incentive to stand up and point out that the whole thing was bound to crumble. Now, the exact same process is happening with our nation's huge and ultimately unsustainable pile of student loans. Not to worry—everything is different this time.

The WSJ reports today on just how well student debt is following the script: it's being bundled and sold off as securities to yield-hungry investors, despite its inherent riskiness. Just like those subprime housing loans were! Who cares? Dance until the music stops!

"SLM Corp., SLM +4.22% the largest U.S. student lender, last week sold $1.1 billion of securities backed by private student loans. Demand for the riskiest bunch-those that will lose money first if the loans go bad-was 15 times greater than the supply, people familiar with the deal said...

Investors' hunger for risky loans shows the lengths they are willing to go to generate returns in a period when interest rates are hovering near record lows."

Note that just last week we received our latest update on the ever-growing shakiness of America's student debt load—balances are going up, along with delinquencies. It's all getting worse at the exact same time that investors are piling in. What timing! What flair! What perfectly predictable repetition!

This is all the product of trained investment professionals. Have no fear: they've been through this before.[/QUOTE]

Problems with the student debt argument are as follows:

1. These people aren't paying the loans because they can't afford to. They can't afford to make loan payments and therefore are not contributing to the earnings of these companies and have no relation to stocks.

2. Student loans are not treated like other debt. There is no bubble in student loan debt because it must be repaid. There is no way to get it forgiven and bankruptcy does not effect it. Your tax refunds and wages can be garnished in the same way a dead beat parent has garnishments happen.

In short, student loans will be repaid weather you like it or not.

I should throw in, your claim makes no reference to company profits. Explain the relevance. The article is not implying that company profits will fall but that somehow (unexplained) these debts won't be repaid. 1.2 billion in securities is nothing. It's a joke compared to the housing market.

The article is nothing but sensationalist nonsense to get clicks by the uneducated. The comments below it pretty much go over what I mention above and a few other things such as subprime mortgage debt was an order of magnitude greater than these loans they're describing. Also take into consideration that about half of student loan debt is owed to the federal government and 75-80 billion dollars is absolutely nothing next to the current federal debt of 14 trillion (1 trillion is the same as on thousand billions so 14 trillion is the same as a pile of a billion dollars 14,000 times). The federal government has debt problems but this would barely do anything and that's assuming that 100% of them defaulted which is not going to happen.

I reiterate. Nonsense article for the uneducated people prone to running around thinking the sky is falling.

ing up.

ing up.